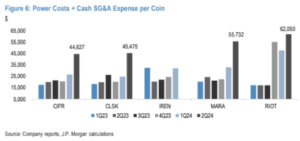

The Bitcoin mining sector is facing significant challenges following the recent halving in April 2024 and the rise in energy costs. According to a new report from JPMorgan, miners’ profits are shrinking, with many industry players struggling to adapt to this new reality.

📅 A Historic Quarter for Bitcoin Mining

The second quarter of 2024 was marked by a crucial event for miners: Bitcoin’s fourth halving. This event reduced the reward for mining a block from 6.25 BTC to 3.125 BTC, effectively halving the amount of Bitcoin mined daily. This had a direct impact on profit margins, reducing profitability across the sector.

JPMorgan analysts Reginald Smith and Charles Pearce highlighted in their report that “Bitcoin miners have faced a significant reduction in margins and profitability across the entire sector.” The reduction in rewards has forced miners to adapt quickly, with some seeking to increase their efficiency while others explore new opportunities to remain competitive.

🔄 Adaptations and Strategies of Bitcoin Miners

The response of miners to the decline in profits has varied depending on their available resources. Cash-rich miners, such as Riot Platforms and Cleanspark, have adopted a strategy of acquiring other turnkey mining facilities to increase their hashrate in the short term and improve production capacity. These miners have sought to expand their power supply lines to compensate for the reduction in rewards.

On the other hand, capital-constrained miners, such as IREN and Cipher, have focused on acquiring greenfield opportunities, which require less immediate capital but offer long-term growth potential.

According to JPMorgan, the five major publicly traded Bitcoin miners mined 5,854 BTC in the second quarter of 2024, a 28% decline from the previous quarter. Marathon Digital Holdings maintained its lead in terms of the number of BTC mined, earning 2,056 BTC during the period analyzed.

💡 Investments and Business Diversification

Some miners, like CleanSpark, have sought to expand their operations by heavily investing in the sector. CleanSpark invested $231 million in the second quarter, earning about 27% of the total Q2 revenue among the miners examined in the report.

In an effort to keep up with the growing demands of the sector and remain competitive, the five major miners issued approximately $1.2 billion in stock. This move allowed them to raise funds to support their operations and address the challenges posed by declining rewards and rising costs.

🌐 Diversification and the Future of Mining

In response to the difficulties of traditional mining, some industry players are exploring new avenues. Hive Digital Technologies Ltd. (HIVE), for example, recorded a 36% increase in sales in the second quarter of 2024 by diversifying its business into artificial intelligence (AI) applications. This move has allowed HIVE to offset the reduction in profits from Bitcoin mining.

Others, such as Bitdeer Technologies Group, are doubling down on BTC mining with advanced equipment, aiming to maintain their leadership position in the sector despite current challenges.

📊 Conclusions

The Bitcoin mining sector is undergoing a significant transformation, with the halving and rising energy costs forcing miners to rethink their strategies. While some are looking to expand and diversify their operations, others are exploring new technologies to stay competitive.

The future of Bitcoin mining will likely be characterized by greater efficiency and the adoption of new technologies, such as artificial intelligence, to sustain profitability in an increasingly competitive environment. However, the challenges posed by the halving and energy costs remain significant, and only time will tell which strategies will prove successful in the long run.