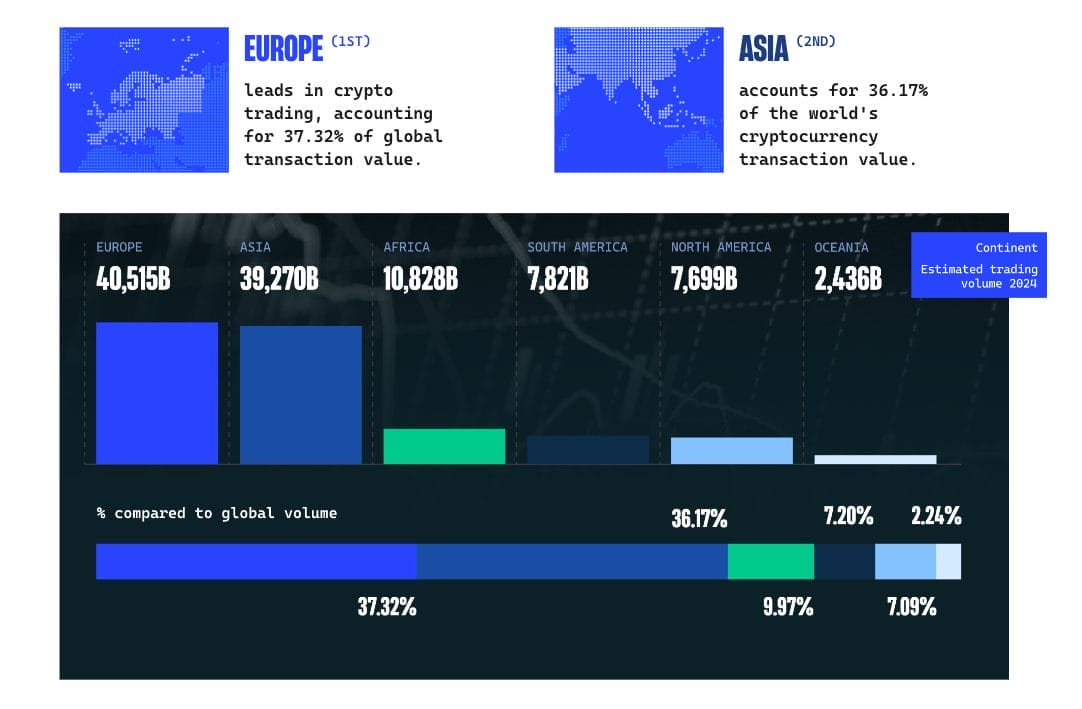

In the dynamic world of cryptocurrency trading, Europe emerges as a crucial hub, surpassing other regions in transaction volume. A recent study by CoinWire reveals that Europe is not only gaining ground but is also well-positioned to dominate the global cryptocurrency trading landscape.

📈 Europe at the Center of Cryptocurrency Commerce

CoinWire’s report estimates that global cryptocurrency transaction volume will surpass $108 trillion by the end of the year, marking an increase of nearly 90% from 2022. This surge in activity is a clear indicator of the sector’s rapid expansion. Europe stands out particularly, accounting for 37.32% of global cryptocurrency transactions, with projections seeing its volume tripling from $15 trillion to $40.5 trillion in 2023.

🔍 What Is Driving This Boom?

Europe has seen a significant boost thanks to evolving regulatory frameworks such as the Markets in Crypto Assets (MiCA), launched in 2020 and finalized by EU officials in October 2023. This regulation aims to make the crypto asset sector more transparent and secure for investors, establishing clear guidelines and definitions for various digital assets.

🌟 Leading Figures: Russia and the United Kingdom

Russia has established itself as a leader in cryptocurrency transactions in Europe, with a volume exceeding $633 billion. This places it among the top five countries globally. A key factor behind this volume is the limited access to international financial services, prompting many to use cryptocurrencies for cross-border transactions. The United Kingdom is not far behind, with a volume of over $624 billion, ranking second in Europe and sixth worldwide.

🚀 Surprises from the Continent

Countries like Slovenia and Ukraine emerge as unexpected champions. Slovenia has a per capita monthly spend on cryptocurrencies of $2,609, while in Ukraine, the challenging economic situation has made crypto assets a vital substitute for fiat currency.

🌏 Global Contrasts and Future Prospects

While Europe experiences tremendous growth, other regions such as Asia and Africa are accelerating their transaction volumes. However, North America is experiencing a slowdown, with a decrease in trading volume expected this year.

🏆 Conclusion

Europe is clearly defining its role as a leader in the global cryptocurrency market. With supportive regulations like MiCA and growing institutional interest, the continent is well-positioned to capitalize on this wave of financial innovation. Moreover, the report suggests a promising future for cryptocurrency trading, with Europe at the heart of this transformation.